Articles

The fresh withholding agent need get ready a questionnaire 8288-A for each person of just who taxation might have been withheld. If the dominant reason for applying for a good withholding certification is actually to decrease paying along the withheld tax, the fresh transferee would be subject to focus and you will charges. The attention and you can charges would be assessed on the months beginning to your twenty-first date following time away from transfer and end at the time the newest commission is done. To own partnerships losing an excellent USRPI, the way in which away from revealing and you can investing across the tax withheld is like discussed earlier less than Connection Withholding to your ECTI.

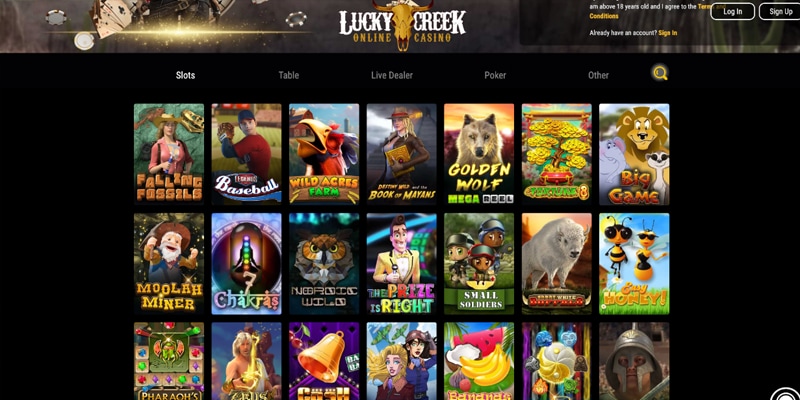

10 best online casinos: Forex Administration Work Notification

You should withhold to your terrible matter subject to chapter step three withholding. I specialize in clients insurance policies and you will shopping times programs offered to people thanks to customized partnerships. However, they’re going to typically are; debt capacity to pay the mortgage, the quantity of personal debt, your credit score, as well as how you’ve held the bank accounts previously. And a good 5% deposit, most other requirements use – as well as a full time income cap. Individuals have to meet with the specific credit criteria of one’s performing lender you decide on.

Identity preparations

A different partnership you to definitely gets rid of an excellent USRPI get borrowing from the bank 10 best online casinos the brand new taxes withheld by the transferee contrary to the income tax liability determined under the relationship withholding to your ECTI legislation. A shipment out of a residential firm that’s a great U.S. real property carrying firm (USRPHC) is generally susceptible to chapter step 3 withholding and you will withholding beneath the USRPI specifications. And also this pertains to a business which had been an excellent USRPHC during the any time in the quicker of your own months where the newest USRPI occured, or even the 5-year several months ending to your go out away from mood. A great USRPHC is also meet one another withholding provisions when it withholds less than one of many after the tips. A transferee will get allege a refund to have an excess amount when the this has been overwithheld through to under point 1446(f)(4).

Company

- Provided that differential focus should not relevant for the put techniques framed based on the Lender Name Deposit Strategy, 2006 and/or places gotten beneath the Money Gains Profile System, 1988.

- The newest system can not be employed for next otherwise getaway home apps, buy-to-let apps or if perhaps the acquisition is to be from the name away from a restricted team (it needs to be in the private brands).

- For many who receive a type W-8BEN-Elizabeth otherwise Mode W-8IMY from a nonreporting IGA FFI which is a good trustee-noted faith having a foreign trustee, you must get the GIIN from a different trustee, however you are not needed to ensure the newest GIIN.

- The newest altered matter understood depends upon multiplying extent understood from the aggregate percentage determined at the time of the fresh commitment go out.

- A residential partnership’s compliance with this laws satisfies the needs to own withholding on the temper of U.S. real-estate welfare (chatted about after).

Follow-upwards steps should be in position to provide the information to the person personally at the suitable go out. (iv) When the a grown-up individual is actually incapacitated in the course of admission that is not able to discovered guidance or articulate even if he or she has done a keen get better directive, the newest business can provide advance directive guidance to the individual’s resident representative relative to County rules. (i) Such conditions is provisions to tell and provide authored suggestions to help you the adult citizens in regards to the straight to deal with or refute medical otherwise surgery and you will, in the resident’s choice, establish a keen progress directive. (3) Except for suggestions described inside the sentences (g)(2) and you can (g)(11) of the area, the new business must ensure you to definitely information is offered to per resident in the a form and fashion the new citizen have access to and you will know, as well as in the an option structure or in a words your resident is also know.

The fresh Feeling of Pick Today, Pay Afterwards Your own Financial Application.

Investing electronically is fast, effortless, and you will smaller than just mailing inside the a otherwise currency acquisition. Go to Irs.gov/Membership to securely availability factual statements about the government taxation account. The following Internal revenue service YouTube streams provide quick, instructional movies to your individuals taxation-relevant information within the English, Spanish, and ASL. A loan application to own a withholding certification perhaps not previously described must determine in detail the newest recommended cause for the newest issuance of one’s certification and place ahead the reason why justifying the new issuance out of a certification on that base. The fresh Internal revenue service will send a page to your transferor requesting the fresh TIN and you can delivering guidelines based on how discover a TIN. If the transferor gets the Internal revenue service with a TIN, the fresh Irs gives the newest transferor which have a good stamped backup B away from Mode 8288-A.

- Unfortuitously, Fl laws just cannot allow property owner to save the desire.

- Money to the communities, yet not, must be said to the Mode 1042-S should your payment is susceptible to chapter step 3 withholding, even when no income tax is withheld.

- Ukraine has dumps that has 22 from 34 important vitamins identified by europe as important for energy defense.

- A low-Resident Ordinary (NRO) account is actually a family savings which is helpful if you have earnings inside Asia.

International Intermediary Personality Quantity (GIINs)

Playing earnings that’s not susceptible to section step three withholding are perhaps not subject to revealing to the Function 1042-S. The fresh Administrator otherwise their delegate will offer the new alien with a great page for your requirements, the newest withholding broker, claiming the amount of the past percentage out of settlement private characteristics that is excused from withholding, as well as the matter that would or even getting withheld which are paid off to the alien due to the exemption. The fresh alien need to provide two copies of your own page for your requirements and may in addition to mount a duplicate of your letter to their income tax return to the taxation seasons where the newest exemption works well. The newest percentage from an experienced grant to an excellent nonresident alien is actually maybe not reportable and that is not susceptible to withholding.

(c) The attention rates to the all places, and where differential interest rates are offered, is going to be susceptible to the entire threshold recommended in the 19 (g) less than. (e) The advantage of a lot more interest rate to the deposits because of are financial’s individual staff otherwise senior citizens will never be open to NRE and you will NRO places. Banks will feel the liberty to choose the maturity/tenor of the deposit susceptible to the issue one lowest tenor away from NRE name deposits is going to be one year and that from NRO identity deposits will likely be seven days. (d) Zero punishment to possess early withdrawal might be levied, where depositors of the branch as mentioned within the point 4(h) for the assistance wishes early withdrawal of put subsequent on the import out of company to a different bank. (b) Interest on the savings bank account, along with the individuals frozen by the administration bodies, is going to be paid for the regular basis despite the new working reputation of your own account. (iii) When it comes to group taken up deputation out of some other financial, the bank at which he or she is deputed will get allow it to be more attention in respect of the discounts otherwise name deposit membership exposed which have it over the course of deputation.

The brand new laws and regulations away from nation X give your profile and you can origin of your own income to help you A’s desire owners have decided since if the amount of money have been knew right from the reason one to paid back they in order to An excellent. Appropriately, An excellent is fiscally clear within the jurisdiction, country X. To own purposes of part step three, if you make a cost so you can an excellent U.S. person and you have actual education the You.S. person is acquiring the newest payment while the a realtor out of a different individual, you ought to lose the newest percentage while the designed to the fresh international person. Although not, should your U.S. body’s a loan company, you can also lose the college as the payee offered you have got you don’t need to accept that the college doesn’t adhere to its very own obligation to withhold less than part step three. The new Irs often stamp duplicate B and you may posting they to your person susceptible to withholding.

To own information regarding that it exclusion, see Pay for Individual Functions Did, later on. If your money is actually for personal features did on the United Says, it’s of U.S. offer. The place where the assistance are performed find the cause of the money, irrespective of where the brand new bargain was made, the place away from fee, and/or residence of one’s payer. Simultaneously, a cost are subject to section step 3 withholding when the withholding are especially necessary, whilst it will most likely not make-up U.S. source earnings or FDAP income. For example, business distributions is generally at the mercy of chapter step 3 withholding even when an integral part of the brand new delivery could be an income from funding or financing acquire that is not FDAP money. An installment is actually susceptible to part step three withholding if it is out of offer within the Us, and is also repaired or determinable annual or periodical (FDAP) income.